Introduction

Bitcoin represents humanity’s first successful decentralized digital currency, solving the double-spending problem through an elegant combination of cryptography and economic incentives. Since its launch in 2009, the Bitcoin network has operated for 15+ years with no major downtime, securely processing billions of dollars in value[1]. This resilience and independence from any central authority have earned Bitcoin comparisons to “digital gold,” touted as a store of value and hedge against fiat currency debasement[2][3]. However, beneath the revolutionary proof-of-concept lie significant limitations and threats that cast uncertainty on Bitcoin’s long-term viability. There is a growing gap between the idealized narrative and operational reality: claims of decentralization meet the practical dominance of a few players; promises of a new monetary paradigm clash with extreme price volatility and environmental costs; and technical roadblocks from scalability to quantum computing loom on the horizon.

This comprehensive analysis will delve into Bitcoin’s most critical challenges – both present and future – and examine how they might be addressed. We will explore issues of network centralization, market integrity, scalability, security economics, and technological obsolescence. Furthermore, we consider how other blockchain implementations like Ethereum and Solana have approached some of these concerns with alternative designs. The goal is an accessible yet in-depth exploration, casting a sober eye on known weaknesses while seeking “eternal and meaningful truths” from Bitcoin’s grand experiment. In doing so, we navigate not only the known unknowns but also speculate on the unknown unknowns of decentralized systems. Ultimately, Bitcoin’s greatest contribution may be demonstrating what is possible – and revealing what is necessary – for the future of cryptocurrency. By examining its constraints and comparing innovations from newer platforms, we can illuminate the path forward for trustless digital money, and perhaps discover how truth and transparency might prevail in the evolution of finance.

Decentralization: Ideals vs Reality

Bitcoin’s ethos centers on decentralization, aiming to distribute power across a broad network of participants rather than any central authority. In theory, no single entity should control the ledger or dictate the rules. In practice, however, Bitcoin has seen power concentrations emerge in several areas, challenging the ideal of a truly decentralized system.

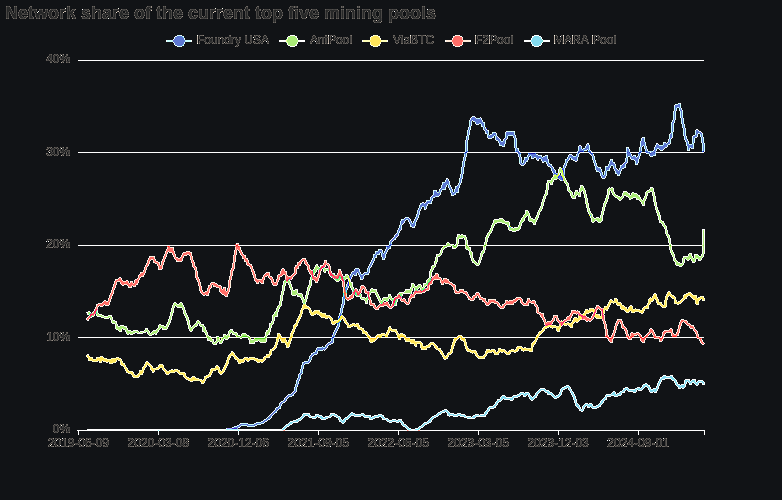

Mining Centralization: Bitcoin’s security relies on proof-of-work mining, but over time this industry has consolidated. As of 2024–2025, roughly 96–99% of Bitcoin blocks are mined by only six major mining pools[4]. This means a handful of pool operators effectively decide which transactions get included in new blocks, wielding significant influence. Notably, the two largest pools (Foundry USA and AntPool) together control on the order of 60–70% of the network’s hashpower[4], giving them outsized potential to affect the blockchain if they were ever to collude.

Network share of the largest Bitcoin mining pools over time, 2019–2024. By early 2024, Foundry USA (blue line) and AntPool (yellow line) together exceeded 50% of hash power, with the top 6 pools mining over 95% of blocks[5][6]. Such concentration raises concerns about Bitcoin’s decentralization and censorship resistance.

Several factors drive this centralization. Mining has significant economies of scale – industrial miners with cheap electricity and specialized hardware (ASICs) have edged out small hobbyists. Most of these ASIC devices are manufactured by a few companies (notably Bitmain, MicroBT, and Canaan in China). In fact, Chinese firms manufacture about 99% of the world’s Bitcoin mining hardware[7]. Even after China’s government banned domestic Bitcoin mining in 2021, experts estimate 55–65% of global mining operations still have roots in China through capital, hardware, and expertise[8][9]. In short, although Bitcoin itself is stateless, the infrastructure securing it is heavily tied to a few geographic and corporate entities. This exposes Bitcoin to potential geopolitical or supply-chain risks – for example, policy changes or disruptions in those dominant regions.

Node and Development Centralization: Beyond mining, true decentralization requires a broad base of independent full nodes (which verify the blockchain) and a decentralized process for software changes. Anyone can run a Bitcoin node, but the rising blockchain size (hundreds of gigabytes) and bandwidth needs pose mild barriers. More significantly, protocol development tends to be handled by a relatively small group. Bitcoin Core (the reference software) is maintained by a cadre of veteran developers – only a handful of maintainers have commit access to merge code changes[10]. While they act with community input and consensus, this means the evolution of Bitcoin’s protocol rests in part on trust in a small team of experts, rather than a large democratic process. Bitcoin’s governance is informal and consensus-driven, which has benefits for stability, but it also meant that critical debates (such as the 2017 block size conflict) were resolved by influence of prominent developers and miners rather than all users equally. This quasi-centralized governance contrasts with, for example, Ethereum’s more structured process (Ethereum Improvement Proposals and core dev coordination) or on-chain governance in some newer blockchains.

It is worth comparing how Ethereum and Solana address decentralization. Ethereum started with proof-of-work but in 2022 transitioned to proof-of-stake (PoS) consensus. In PoS, anyone with 32 ETH (currently) can stake and become a validator, proposing and voting on new blocks. This removed the need for energy-intensive mining and potentially widened participation – as of 2025, Ethereum has over 700,000 active validator slots, indicating a large validating set. However, stake-based systems have their own centralization vectors. Many Ether holders stake via large pooling services (Lido, Coinbase, etc.), and indeed Lido Finance (a staking collective) accounts for roughly one-third of Ethereum’s stake, a not-insignificant concentration of voting power. Still, Ethereum’s validator set is geographically diverse and the barrier to entry (32 ETH or even less via pools) is arguably more accessible than acquiring competitive ASIC hardware for Bitcoin. Ethereum’s client software development is also more distributed, with multiple independent teams (Prysm, Geth, Nethermind, etc.) maintaining different implementations – a deliberate effort to avoid single points of failure in software[11]. Core developers in Ethereum are often funded by the Ethereum Foundation or companies, making it a more organized (if somewhat centralized) governance model than Bitcoin’s volunteer-driven process[12].

Solana, a newer platform launched in 2020, takes a different tack. It uses a high-performance Proof-of-Stake combined with “Proof of History” (PoH) for timestamping. Solana emphasizes speed and throughput, but this design has resulted in more centralization in practice. The hardware requirements to run a Solana validator are steep – high-end CPUs, large memory, and bandwidth – which limits who can feasibly participate. As a result, Solana’s network tends to concentrate in a few hundred validators often running in data centers. As one analysis noted, “Solana is considered more centralized than Bitcoin because running nodes on its network requires higher hardware specifications, which limits the number of participants who can operate nodes.”[13]. In fact, Solana’s impressive capacity (thousands of transactions per second) is achieved partly by relying on a smaller set of powerful nodes to process transactions in parallel[13][14]. This is a trade-off by design: Solana sacrifices some decentralization for performance, under the assumption that a moderately decentralized but very fast network is acceptable for many applications.

The implications of centralization in any supposedly decentralized network are serious. If a few mining pools coordinate, they could in theory censor transactions or even attempt a 51% attack (rewriting recent history) on Bitcoin. Indeed, researchers point out that even with ~40% of hash power, a single pool has about a 50% chance to win six blocks in a row (enough to cause a deep reorg) given random luck[15]. In Ethereum’s PoS, a cartel of large stakers could potentially influence finality or censor certain transactions (an issue raised when some validators, following government sanctions guidance, briefly censored certain transactions in 2022). And in Solana, the small validator count has led to several network halts – the validators were able to coordinate restarting the network during outages, something impossible on Bitcoin but indicative of a more federated trust model. In summary, while Bitcoin remains more decentralized than most cryptocurrencies by some measures (anyone can run a node, no foundation controls it, etc.), the concentration of critical resources (hash power, hardware manufacturing, development decisions) contradicts the pure decentralization narrative. Recognizing these realities is important, as decentralization is not a binary – it’s a spectrum where Bitcoin, Ethereum, Solana and others each occupy different points, balancing security, efficiency, and openness.

Volatility and “Digital Gold” – Economic Viability

Bitcoin’s proponents often brand it as “digital gold” – a scarce store of value and hedge against inflation or unstable fiat currencies[16][3]. Indeed, Bitcoin’s supply is algorithmically capped at 21 million coins, and its monetary policy is transparent and predictable. In theory, these attributes could make it a reliable long-term store of wealth. In practice, however, Bitcoin’s extreme price volatility undermines this narrative as well as its usefulness as a currency for day-to-day transactions.

Over the past decade, Bitcoin has experienced multiple boom-and-bust cycles with price swings routinely exceeding 50–80% declines from peaks. Such volatility is far higher than traditional assets or even gold. For example, during the late 2017 rally and subsequent 2018 crash, Bitcoin rose to nearly $20,000 and then fell below $4,000 in the span of a year. More recently, in 2021 it surged to ~$69,000 and then dropped to ~$20,000 by 2022. This level of unpredictability has led many economists and financial experts to dismiss Bitcoin as a speculative bubble rather than a stable store of value. As one observer noted, many reputable economists claim that Bitcoin and cryptocurrencies in general are “purely speculative and have no fundamental value.”[17] Mainstream economic theory struggles to find an intrinsic value for Bitcoin beyond what the next person will pay for it – there are no cash flows, no backed assets, and usage as a medium of exchange remains limited. Nobel-winning economists like Paul Krugman and outspoken critics like Nouriel Roubini have variously called Bitcoin a “bubble” or even a “Ponzi-like” scheme, arguing that its price is driven mostly by greater-fool speculation. Roubini in particular has charged that “The price of Bitcoin is totally manipulated by a bunch of people, by a bunch of whales. It doesn't have any fundamental value.”[18] Such harsh assessments reflect a consensus in much of the economist community that Bitcoin’s volatile price behavior is incompatible with the qualities of money (unit of account, medium of exchange, stable store of value).

Volatility also impedes adoption as a currency. For a currency to function, people need a reasonable expectation of its short-term value. If the value can change 10% in a day (as Bitcoin often does), it’s risky to set prices in it or to hold it for making payments. Merchants accepting Bitcoin must frequently convert to stable currency to avoid losses, and consumers have an incentive to either hoard (if they expect price to rise) or avoid spending (if they fear price might crash right after they spend). This has kept Bitcoin’s use in everyday commerce low. By transaction count, much of the on-chain activity is related to exchange deposits/withdrawals or speculative movement, not buying coffee. El Salvador’s much-publicized adoption of Bitcoin as legal tender in 2021, for instance, has seen low uptake in practice, partly because locals quickly convert any received BTC to dollars to avoid volatility risk.

How have Ethereum and others addressed the volatility issue? It must be noted that Ethereum’s native asset (Ether) is also volatile (though its market dynamics differ somewhat from Bitcoin). Ether has utility beyond a currency – it powers decentralized applications and smart contracts on the Ethereum network – but it still doesn’t have a fixed value peg. Ethereum’s approach to the volatility problem has been indirect, primarily through facilitating stablecoins in its ecosystem. A stablecoin is a cryptocurrency pegged to a stable asset (often USD). The Ethereum blockchain is the backbone for major stablecoins like USDC, USDT (Tether), and DAI. These stablecoins allow users to transact in a cryptocurrency token without exposure to volatility, since 1 USDC is intended to hold value ~$1. In practice, this means that while Ether’s price swings, much of the economic activity on Ethereum (decentralized finance, trading, payments) can and does occur in stablecoins. This has somewhat mitigated the issue for Ethereum’s usability: one can use the Ethereum network for payments or loans in a stable unit (dollars, via a stablecoin), whereas on Bitcoin there is no widely used stablecoin on its base layer (Tether exists on Omni and Liquid sidechains, but not commonly in Bitcoin main-chain transactions). Ethereum’s philosophy is not to make Ether itself stable, but to enable stable tokens to circulate on its platform.

Solana similarly hosts stablecoins (USDC and others have Solana versions) and was even closely linked to stablecoin usage (FTX and Alameda, major Solana backers, facilitated Solana-USDC liquidity). Solana’s high throughput could in theory make it a good network for day-to-day purchases if a stablecoin is used to denominate prices, avoiding exposing users to SOL token volatility. In short, alternative chains have embraced stablecoins and smart contracts as a solution to currency volatility, whereas Bitcoin purists have generally been averse to anything that isn’t the BTC asset itself. This highlights a philosophical difference: Bitcoin’s design sticks to being a singular asset-ledger (with BTC as the unit of value), whereas Ethereum, Solana, and others function more as platforms where many tokens (including stablecoins) can exist to serve different purposes.

Nonetheless, volatility remains a fundamental challenge for any asset aiming to be “significant and meaningful” in the global financial system. It raises the question: can Bitcoin truly become a global reserve asset or mainstream currency if its valuation behaves like a tech stock or a digital commodity with speculative cycles? Some argue that as adoption increases and the market cap grows, volatility will naturally dampen (as larger markets are harder to sway). There is some evidence that Bitcoin’s volatility has decreased relative to its early years, but it is still far above fiat currencies or gold. Until and unless that changes, Bitcoin’s role may remain an investment vehicle or store-of-value for those tolerant of risk, rather than a stable unit of account. It’s possible that Bitcoin will settle into a role akin to digital gold – valuable and worth holding, but not used to price your grocery bill – while day-to-day crypto-economic activity uses other solutions (like stablecoins or national CBDCs on blockchain rails). The truth-seeking perspective here recognizes that collective belief and narrative drive much of Bitcoin’s value (as the Medium article hinted[17]). If that belief falters or is replaced by a new narrative (say, preference for a different crypto asset), Bitcoin’s volatility could cut both ways, potentially undermining its “digital gold” thesis in the long run.

Environmental Impact and Consensus Mechanisms

One of the most high-profile criticisms levied at Bitcoin is its environmental footprint. Bitcoin’s security comes from proof-of-work mining, an intentionally energy-intensive process. As the network has grown, so has its electricity consumption – to levels that spark intense debate about sustainability and waste.

By recent estimates, the Bitcoin network’s annual electricity usage is in the same range as a mid-sized country. In September 2025, the Cambridge Centre for Alternative Finance estimated Bitcoin mining consumes about 211 terawatt-hours per year, roughly 0.83% of global electricity consumption[19]. Other analyses put it around 0.5% of world electricity in earlier years[20]. For perspective, 0.5–0.8% of world electricity is on the order of what countries like Malaysia or Thailand use. It also means Bitcoin alone uses more electricity than many large tech companies – for example, one report noted Bitcoin consumes over 7 times as much electricity as all of Google’s global operations[21]. This comparison drives home the scale: securing a single digital currency (handling perhaps 300,000 transactions per day on-chain) is eating more power than a corporation running countless data centers serving billions of search queries and emails. Critics highlight this disparity, pointing out that Bitcoin may account for only a tiny fraction of global transactions (far less than 0.1% of digital payments), yet it gobbles up nearly 1% of global electricity – an arguably inefficient trade-off.

The environmental costs are not just about electricity usage, but also the carbon footprint. Much of Bitcoin mining has historically been powered by coal and other fossil fuels, particularly in regions like China’s Xinjiang (pre-2021) or Kazakhstan. Although an increasing share of mining is now using renewables or stranded energy (and the Cambridge Bitcoin Electricity Consumption Index suggests about 52% of mining power comes from non-fossil sources[22]), the network’s absolute carbon emissions remain significant – comparable to cities like Las Vegas or even small countries. This has made Bitcoin a target of regulators and environmental activists. In some jurisdictions, there have been proposals or actions to ban proof-of-work mining for environmental reasons (e.g. a proposed moratorium in New York State, a debated ban in the EU that ultimately did not pass, and China’s aforementioned ban which was partly motivated by energy concerns). The political vulnerability here is real: as governments strive to meet climate goals, an energy-hungry monetary system that some see as non-essential could be heavily taxed or regulated. It’s a paradox: Bitcoin’s design ties its security to a “physical cost” (energy) rather than trust in institutions – which is philosophically powerful – but that very design pits it against global efforts for energy efficiency and carbon reduction.

In response to these concerns, other blockchain projects have pursued alternative consensus mechanisms that avoid proof-of-work’s energy cost. The most notable shift was Ethereum’s “Merge” in 2022, where Ethereum transitioned from proof-of-work to proof-of-stake. This move eliminated roughly 99.95% of the network’s energy consumption[14]. Under proof-of-stake, Ethereum no longer requires miners burning electricity; instead, validators lock up Ether as collateral and consume only trivial amounts of energy (just enough to run a node). The effect was dramatic – Ethereum’s electrical usage went from an estimated ~60 TWh/year to effectively negligible overnight. For environmental sustainability, proof-of-stake is a clear win. It demonstrates that a blockchain can be secured without continuously expending vast energy. Ethereum’s successful switch provided a template that other projects can reference to silence the critique of wastefulness.

Solana, from its inception, used a form of proof-of-stake (combined with a unique Proof-of-History mechanism for ordering transactions). Therefore, Solana’s energy usage has also been minimal compared to Bitcoin. Solana’s design aimed to maximize speed and capacity but within a more energy-efficient PoS framework. Many other prominent cryptocurrencies (Cardano, Tezos, Algorand, etc.) similarly use PoS or other low-energy algorithms. In fact, after Ethereum’s move, Bitcoin stands almost alone among top networks in using proof-of-work (with the exception of some smaller coins like Litecoin or Monero). This has somewhat isolated Bitcoin in the public environmental debate.

Bitcoin proponents of course offer counter-arguments: they claim much mining energy is renewable or from otherwise wasted sources (e.g. excess hydropower, flared natural gas). They argue that Bitcoin incentivizes development of clean energy and acts as a flexible buyer of last resort for electricity (since miners can turn on/off quickly). While there is some merit to these points (miners have indeed utilized stranded energy sources in places like Texas oilfields or hydropower in rainy season China[23][24]), it’s unlikely to fully defuse the controversy. The perception problem remains that Bitcoin is using a notable chunk of the world’s power for what many see as speculative gain or a narrow purpose.

From a truth-seeking perspective, one might ask: is the massive energy burn an essential feature (for security) or an unnecessary side effect that can be engineered away? Bitcoin maximalists contend that Proof-of-Work’s tangible cost is what makes it secure (“energy-backed currency” analogous to how gold’s difficulty to mine gives it value). They worry that proof-of-stake, by removing an external cost, could lead to new vulnerabilities (nothing-at-stake problems, rich-get-richer centralization, etc.). However, the reality is that Ethereum’s network has continued to run securely under PoS, and its security now derives from economic penalties (slashing of misbehaving validators) rather than energy expenditure. There is ongoing debate about the relative security of PoW vs PoS, but it’s clear that the industry trend has shifted to PoS for its efficiency. Even major financial institutions and tech companies that are interested in blockchain (but also have ESG commitments) are far more receptive to supporting proof-of-stake-based networks or permissioned networks.

In summary, Bitcoin’s environmental impact is a self-inflicted limitation stemming from its proof-of-work foundation. Where Bitcoin uses on the order of 0.5–0.8% of global electricity for a few hundred thousand daily transactions[20][19], newer systems like Solana handle orders of magnitude more transactions with a fraction of the energy. Ethereum has demonstrated that it’s possible to drastically cut energy usage and still maintain a robust decentralized network[14]. The long-term threat here is twofold: political/regulatory action against PoW, and a potential shift in public sentiment that could reduce Bitcoin’s appeal in favor of “greener” alternatives. Already, we see investors and companies factoring environmental impact into their crypto strategy (for instance, some ESG-focused funds exclude Bitcoin but include proof-of-stake assets). Bitcoin’s community appears staunchly against changing to PoS – it would be a heretical change, undoing the very principle of PoW that Satoshi embedded. Thus, Bitcoin is likely to keep using PoW, but that means this criticism will not go away. It remains to be seen whether innovations like Layer-2 networks (which we discuss next) can alleviate some of the pressure by moving transactions off-chain, or if Bitcoin will find ways to use more renewable energy to improve optics. Regardless, the environment vs. Bitcoin narrative is a classic example of a “known known” limitation that future generations of cryptocurrency must account for in their designs – and indeed they already are.

Market Integrity and Regulatory Challenges

Another area where Bitcoin’s shine meets harsh reality is the integrity of the markets surrounding it. The cryptocurrency ecosystem that Bitcoin spawned is still lightly regulated in many jurisdictions, and this has led to concerns about market manipulation, opaque practices, and regulatory risks. Bitcoin does not exist in a vacuum; most people access it through exchanges, whose honesty and robustness directly affect Bitcoin’s credibility. Key issues include the role of stablecoins like Tether, major exchanges’ behavior, and government regulation of the crypto industry.

The Tether Question: Tether (USDT) is the largest stablecoin and often used as a dollar proxy in crypto trading. It’s supposed to be backed 1-to-1 by reserves, but historically Tether’s operations (closely linked to the Bitfinex exchange) have been murky. Of particular concern is evidence suggesting that Tether issuance has been used to prop up Bitcoin’s price during market downturns, raising the specter of market manipulation. A notable academic study by Griffin and Shams (2018) found that just 1% of hours with heavy Tether printing were associated with 50% of Bitcoin’s 2017 price rise, implying that large Tether releases systematically pushed Bitcoin upward[25]. They concluded that “Tether flows to other exchanges after periods of Bitcoin price declines, and these flows have a strong effect on future Bitcoin prices.”[26] In other words, when Bitcoin was dropping, new Tether would appear and be used to buy Bitcoin, driving the price back up – a pattern inconsistent with purely organic demand. The authors argued this was likely strategic market support, possibly by entities affiliated with Bitfinex/Tether. Bitfinex vehemently denied these claims[27], but the concerns linger. Additionally, the U.S. Commodity Futures Trading Commission (CFTC) and the New York Attorney General investigated Tether; in 2021, Tether admitted in a settlement that it had not been fully backed at all times and paid fines. Despite this, Tether’s market cap continued to grow (over $80 billion by 2023), suggesting many traders either trust it or feel it’s a necessary liquidity tool.

The implication for Bitcoin is that its market price may not be purely the result of millions of independent investors, but potentially influenced by a few players who can print and deploy billions of “crypto-dollars” at will. If, say, Tether were found to be fraudulent or collapsed (a scenario often speculated on), it could cause a severe liquidity crunch and crash in Bitcoin’s price. This is a systemic risk: Bitcoin’s value proposition as sound money is undermined if its price is buoyed by what some call “fake liquidity.” The market integrity issue extends to exchanges as well. Unregulated offshore exchanges (like the now-defunct Mt. Gox in 2014, or more recently FTX in 2022) have at times engaged in intransparent or unethical practices – from rehypothecating customer assets to wash trading – which, when uncovered, lead to collapses that hurt Bitcoin holders globally. The collapse of FTX, a major exchange, in late 2022 was a shock that sent Bitcoin’s price down and eroded trust, reminding everyone how interlinked the fate of Bitcoin and the honesty of key market intermediaries are.

Regulatory Crackdowns: As cryptocurrency grew from a niche into a trillion-dollar asset class, regulators finally took serious notice. Bitcoin itself is often viewed by regulators as a commodity (in the U.S., the CFTC has called it a commodity, and SEC Chair Gary Gensler has hinted the SEC doesn’t see Bitcoin as a security, unlike many other tokens). However, the on- and off-ramps (exchanges, brokerages) and many crypto trading activities have fallen into gray areas. In 2023, the U.S. Securities and Exchange Commission launched major lawsuits against the two largest crypto exchanges: Binance and Coinbase. The SEC accused Binance (the world’s largest exchange) of a litany of offenses – inflating trading volumes, commingling customer funds, secretly allowing U.S. users, and operating an unregistered securities exchange among others[28]. Binance’s CEO was charged with operating a “web of deception”[29]. Coinbase was sued for operating as an unregistered exchange as well, since the SEC considers some of the tokens it lists to be securities[30][31]. These actions signaled an aggressive regulatory campaign to bring the wild west of crypto to heel. If regulators are successful, the crypto market could be transformed – with stricter compliance, possibly fewer offshore havens, and certain practices (like offering high-leverage trading or yield products) curtailed[32]. In the short term, this regulatory uncertainty created fear, uncertainty, and doubt (FUD) in markets, and some altcoin prices plummeted on news of enforcement. Bitcoin, interestingly, was somewhat insulated – in fact, during the 2023 crackdowns on altcoins, some investors rotated funds into Bitcoin, viewing it as the safest asset in the space not targeted by the SEC[33]. Still, regulation is a double-edged sword for Bitcoin. On one hand, clear regulations and oversight could increase institutional trust and adoption (e.g. regulated Bitcoin ETFs, custody by banks, etc.). On the other hand, heavy-handed moves (like banning exchanges from handling Bitcoin, or strict KYC/AML rules that reduce privacy) could dampen usage and push activity underground.

How do Ethereum and Solana fare in these regards? They are not immune either. Ethereum’s ecosystem has its own controversies (for instance, the ICO boom of 2017 which largely took place on Ethereum attracted SEC action on many of those ICO tokens; in 2023 the SEC even hinted that Ether itself might be considered a security under some interpretations, though this is hotly debated). Solana was heavily tied to FTX/Alameda, and its price and reputation suffered when FTX imploded (Solana’s close association with a now-disgraced centralized actor illustrates how even decentralized protocols can have perception ties to centralized institutions). However, one could argue that Ethereum’s broad use cases in decentralized finance (DeFi) provide an alternative to centralized exchanges. On Ethereum, one can trade assets on decentralized exchanges (like Uniswap) or borrow/lend on protocols (like Aave) without relying on a single company. This decentralization of financial infrastructure could, in theory, reduce the impact of any one intermediary’s failure or misconduct. Indeed after FTX’s collapse, DeFi platforms saw renewed interest as a trust-minimized venue for trading. That said, DeFi introduces other risks (smart contract bugs, governance token influence) and often still depends on stablecoins (which bring us back to trusting issuers like Tether or Circle).

In contrast, Bitcoin’s ecosystem has been slower to develop decentralized financial applications (partly by design, since Bitcoin’s scripting capabilities are limited). Most Bitcoin trading or yield generation happens on centralized platforms or via tokenized representations of BTC on other chains. This means Bitcoiners are often more exposed to centralized risk when they want to do anything other than hold. There have been attempts to create Bitcoin sidechains or DeFi-like solutions (Liquid network, RSK, etc.), but none have gained massive traction. The Bitcoin community tends to prioritize security and simplicity over rapid experimentation, which has trade-offs: it avoids smart contract bugs (there’s no equivalent of an Ethereum DAO hack on Bitcoin because Bitcoin doesn’t allow such complex contracts on-chain), but it also means Bitcoin holders inevitably interact with centralized institutions for advanced financial services.

Looking forward, market integrity and regulation remain pivotal threats and opportunities. A major hidden risk is that crypto markets might be more fragile than they appear if manipulation or hidden leverage props them up. Transparency improvements – whether through on-chain analytics or through regulations like proof-of-reserves audits for exchanges – are needed to reveal the truth of crypto liquidity. We have seen progress: after some scandals, a number of exchanges began providing proof-of-reserve attestations (though not all include liabilities, so they are of limited use). Governments worldwide are also crafting clearer rules: the EU passed MiCA (Markets in Crypto Assets regulation) to comprehensively regulate the sector, and many countries are licensing exchanges under existing financial laws. This increased oversight could stabilize markets and weed out bad actors over time, which would benefit Bitcoin’s legitimacy. However, there’s also the threat of over-regulation or hostile regulation – for instance, if a country bans self-custodied wallets or mining (as some have mooted), that could stifle usage and development in that jurisdiction.

In essence, Bitcoin’s journey toward mainstream acceptance is tightly coupled with the maturation of the broader crypto marketplace. As a trust-seeker, one should remain skeptical of market anomalies (like stablecoins that act as central banks with no transparency, or exchanges with peculiar volume patterns) and advocate for truth and transparency in markets as vigorously as for decentralization in technology. Only with cleaner markets can the true value and use of Bitcoin (or any cryptocurrency) be determined without distortion.

Scalability and Layer-2 Solutions – Can Bitcoin Evolve?

From its inception, Bitcoin has faced a fundamental technical constraint: the base layer can process only a limited number of transactions per second (TPS) – on the order of ~5–7 TPS under the original protocol rules[3]. This is a far cry from traditional payment networks like Visa (which can handle tens of thousands TPS) or even newer blockchains like Solana (which boasts theoretically 50,000+ TPS in ideal conditions[13]). Bitcoin’s conservative throughput is a deliberate design choice to maintain decentralization (small 1MB blocks to keep it easy for anyone to run a node). But as usage grew, this led to network congestion and high fees during peak demand (for example, in late 2017 and again in 2021, Bitcoin transaction fees spiked to $20-$50, pricing out small payments). This raised the question: How can Bitcoin scale to a world with millions or billions of users?

The Bitcoin community’s main answer has been the Lightning Network, a Layer-2 protocol launched around 2018. Lightning allows users to open payment channels and transact off-chain with near-instant, low-fee transactions, relying on the Bitcoin blockchain only for occasional settlement of channel open/close or in case of disputes. In theory, Lightning Network could enable millions of transactions per second if adopted widely, since channel transactions are not limited by global block space. In practice, however, Lightning has struggled to achieve broad adoption in its first six years. As of mid-2025, the public Lightning Network holds around 4,000–5,000 BTC in capacity (roughly $100–$150 million) and about 16,000 nodes[34]. While these numbers have grown over time, they are minuscule compared to global payment networks. Moreover, recent data show that public Lightning capacity actually declined by ~20% in 2025, from a peak of ~5,400 BTC down to ~4,200 BTC[35]. The number of channels and nodes on the public network has been in steady decline since 2022[36], indicating some early adopters closed channels or left. Some Lightning advocates note that capacity isn’t the perfect metric – usage could be happening in private channels or via custodial services that don’t show up on public graphs[37]. Indeed, there have been promising signs: major exchanges like Coinbase integrated Lightning for BTC withdrawals in 2024, leading to about 15% of Coinbase’s customers’ BTC withdrawals using Lightning by mid-2025[38]. That suggests a niche but growing role in making withdrawals faster and cheaper. Payment processors (e.g. CoinGate) also report more merchants using Lightning invoices (CoinGate saw Lightning jump to ~16% of Bitcoin payments on its platform in 2024, up from 6% in 2022[39]).

Still, Lightning Network’s overall traction is modest relative to initial hopes. For everyday users, Lightning can be somewhat complex – managing channels and liquidity is not as straightforward as an on-chain transaction. There are user-experience challenges (failing payments when channels lack liquidity, the need to be online to receive unless using hosted services, etc.). Moreover, many Bitcoin users simply may not have the need for frequent small transactions that Lightning is optimized for, preferring to transact on-chain for larger, more infrequent transfers (or they might be using other crypto networks for different purposes). The slow roll-out does raise a concern: if Lightning does not achieve meaningful adoption, Bitcoin’s ability to function as a medium of exchange at scale remains in doubt. On-chain, Bitcoin can handle only a few hundred thousand transactions per day. If global demand ever exceeded that by an order of magnitude, the fee market would skyrocket, likely rendering the base layer a settlement network for large transactions only. This may indeed be the intended path – Bitcoin becomes a settlement layer, like digital gold bars that you move occasionally, and Layer-2 networks handle coffee purchases and retail transactions. But that vision only works if Layer-2 networks truly gain global usage.

Meanwhile, Ethereum tackled scalability through a multi-pronged strategy: on-chain upgrades and off-chain scaling. On-chain, Ethereum increased its block gas limit over time and optimized clients, achieving around 15–30 TPS capacity (still limited, and indeed Ethereum L1 saw crippling fees during DeFi summer 2020 and NFT booms 2021). Recognizing L1 alone won’t scale to millions of TPS, Ethereum’s roadmap embraced Rollups – Layer-2 solutions that keep most of the transaction data off-chain (or in call data) and post proofs to L1. Examples include Optimistic rollups (Arbitrum, Optimism) and Zero-Knowledge rollups (StarkNet, zkSync). By 2025, these rollups are carrying a substantial load: Arbitrum and Optimism collectively process more transactions daily than Ethereum L1 itself, at much lower fees, indicating genuine adoption. The Ethereum community often touts a slogan “the future is rollup-centric” – meaning the base layer will be a secure settlement and data availability layer, while bulk transactions happen on layer-2. In essence, Ethereum’s vision is analogous to Bitcoin’s Lightning in concept (move activity off-chain to scale), but the implementations differ (Lightning is a network of payment channels, rollups are like separate blockchains that report back to L1). One could argue Ethereum’s approach has seen more success so far: billions of dollars in value are now on rollups, and users interact via Metamask with layer-2s relatively seamlessly for trading, gaming, etc. Additionally, Ethereum plans to implement data sharding (proto-danksharding and full sharding) in the future, which will increase the data capacity for rollups and thus overall throughput.

Solana, as mentioned, took another approach: scale on the base layer by making each block as big and fast as technology permits. The Solana blockchain processes thousands of TPS routinely[13], and has peaked much higher during stress tests. This has enabled high throughput applications (for example, Solana was known for its NFT mints and DeFi which could handle much more volume at low cost compared to Ethereum L1, at least until Ethereum’s rollups matured). The cost, however, is the centralization trade-off we discussed: only data centers can keep up with Solana’s firehose of data, which has led to occasional outages. Solana essentially treats scalability as a priority over maximally decentralized validation. Which model yields the “truth” for the future? It could be that multiple paradigms co-exist for different needs: Bitcoin might remain small and decentralized but rely on layers like Lightning for scalability, Ethereum aims for a balanced middle with rollups (semi-decentralized layer-2s anchored to a decentralized layer-1), and Solana goes for raw performance with more trust in validators.

Importantly, scalability ties back to some earlier points: if Bitcoin cannot significantly increase transaction throughput on layer-2, it might hinder the fee revenue growth needed when block subsidies drop (we will discuss the fee issue soon). Also, if Bitcoin cedes the “everyday transaction” use case to other networks, it might end up positioned purely as a settlement network for large transfers and a reserve asset – which could be fine, but it narrows its scope. Some Bitcoin developers are exploring other layer-2 ideas beyond Lightning, such as sidechains (e.g. Rootstock for smart contracts, Liquid for faster exchange settlement) or Drivechains (a proposal to allow Bitcoin miners to secure sidechains). So far, none of those have seen widespread adoption either, partly due to lack of consensus to enable them (Drivechains require soft-fork changes that are controversial).

On the multi-chain front, interoperability is increasing. Wrapped Bitcoin (WBTC) on Ethereum and other chains lets BTC holders use their bitcoin within Ethereum DeFi by entrusting it to a custodian who issues an ERC-20 token. This has ironically allowed Bitcoin to indirectly partake in Ethereum’s high-scalability environment (e.g. you can trade BTC on Uniswap by using WBTC). However, wrapping involves trust (central custodians or federations like BitGo manage WBTC), which is contrary to Bitcoin’s trust-minimized ethos. Nonetheless, the fact that billions in WBTC exist shows that some BTC holders prefer the functionality of other chains enough to accept that trade-off.

In the quest for the “significant and meaningful truths”, scalability is a domain where the rubber meets the road: lofty goals of banking the unbanked or powering a new financial system must contend with throughput limits. Bitcoin’s slow-and-steady approach maximizes security and decentralization at the base layer but assumes the ecosystem will innovate on top for scale. Ethereum and others are more willing to evolve the base protocol to incorporate scaling solutions (Ethereum’s recent history is one of continual upgrades: EIP-1559 for fees, the Merge, upcoming sharding, etc.), guided by a philosophy that the protocol must adapt to meet global demand. Bitcoin’s philosophy is more conservative, placing faith in layered architecture and refusing to “sacrifice” base layer principles for capacity. Time will tell which approach yields a system that is both broadly useful and true to the principle of decentralization. Possibly, the endgame is that Bitcoin acts as the settlement layer for value (digital gold for large holdings and final settlement), while other networks handle day-to-day transactions and perhaps periodically settle back to Bitcoin. This vision requires interoperability and trust between networks, which is still nascent (cross-chain bridges are a point of vulnerability, as seen by several hacks).

To conclude this section: scalability remains an open challenge for Bitcoin. Lightning Network, while conceptually sound, has yet to realize its full promise in practice, and skepticism is warranted until proven otherwise. Other blockchains have addressed scaling via different trade-offs that Bitcoin thus far avoids. The truth may be that there is no free lunch: you can’t maximize security, decentralization, and scalability simultaneously (the classic “blockchain trilemma”). Each project picks two at the expense of the third. Bitcoin has largely picked security and decentralization over throughput; Ethereum is trying to improve scalability while keeping decentralization and security high via layer-2; Solana picked scalability and to a lesser extent security (it’s still secure but more centralized). Understanding this helps set realistic expectations: Bitcoin might never rival Visa on the base layer, but if its layered approach succeeds, it may not need to – the layers built on it could inherit its security for high-volume usage. If those layers fail to gain traction, however, Bitcoin could remain a relatively niche system for settlement and wealth storage, while the world’s transactional demands get served by other platforms or even centralized solutions.

Inherent Security Limits and Economic Constraints

A deeply sobering analysis of Bitcoin’s design comes from the field of economics. While Bitcoin’s cryptographic security (SHA-256 hashing, difficulty adjustments, etc.) is robust, its economic security model has certain limits. In 2018, economist Eric Budish published “The Economic Limits of Bitcoin and the Blockchain,” which argued that Bitcoin is structurally constrained in how “economically important” it can become without inviting attack[40]. The crux of Budish’s argument is an incentive analysis of a 51% attack (majority attack) on Bitcoin.

In a majority attack, an attacker gains control of more than half of the network’s mining power (hashrate) and can then mine an alternative chain faster than the honest chain, allowing them to double-spend (revoke transactions) or halt confirmations. Traditionally, we assume this is infeasible because the cost to acquire that much hashpower and electricity continually is prohibitively high, dissuading any rational attacker. Budish formalized two conditions for equilibrium: (1) miners operate until they earn zero economic profit (competition drives profits to normal levels), and (2) the system is secure if the cost to attack exceeds the potential benefit to the attacker[41][42]. He found that to satisfy these, the “flow” of payments to miners (block rewards and fees over time) must be large relative to any one-off gain from attacking[42].

The worrying insight was that if Bitcoin’s market value becomes very large, the potential reward for disrupting it (for example, by shorting Bitcoin futures and then attacking to tank the price, or a rogue state attacking to destroy Bitcoin’s utility) also becomes very large. Meanwhile, the cost to attack is bounded by the cost of mining equipment and electricity for the duration of the attack. Budish’s model suggested that if Bitcoin became sufficiently important – say a major store of value like gold – it would reach a point where a motivated attacker could rationally spend the money to attack it, because the benefit (e.g. trillions in profit or geopolitical gain) outweighs the one-time cost of hardware/energy[40]. In his words, “the model suggests that Bitcoin would be majority-attacked if it became sufficiently economically important – e.g., if it became a ‘store of value’ akin to gold – which suggests intrinsic economic limits to how economically important it can become.”[40]

This is a profound theoretical limitation: it implies Bitcoin cannot safely scale to become the backbone of the global financial system unless the system pays miners proportionally enormous sums to deter attacks. Another way to see it: today’s Bitcoin is secure partly because it’s not worth the hundreds of billions required to attack it in expectation. But if one day Bitcoin is central to world finance (implying a multi-trillion dollar value), a 51% attack could be attempted by a well-funded adversary (a consortium, a rival nation during conflict, etc.) willing to burn tens or even hundreds of billions to break it. The only way to counteract that would be for Bitcoin’s mining rewards (the “security budget”) to also scale up massively, which either means a much higher steady-state inflation or high fees. However, Bitcoin’s design heads in the opposite direction of declining block rewards, which is the next issue.

The Block Subsidy and Fee Transition: Bitcoin’s monetary policy reduces the block subsidy (new BTC minted per block) by half every 4 years. It started at 50 BTC per block, now (2025) it’s 6.25 BTC, dropping to 3.125 BTC by 2024, and so on until it effectively hits zero around the year 2140. The security of Bitcoin currently is subsidized by this coin issuance – miners earn about \$X million per day from the block reward plus whatever fees. As the reward dwindles, transaction fees must rise to compensate and maintain mining incentives. This is often called the “security budget” problem or the fee regime question. If, in a future scenario, block rewards are, say, 0.1 BTC and almost all miner income must come from fees, will users be willing to pay high fees for block space? If not, miners might not find it profitable to continue investing in hardware and electricity at the same scale, leading to a drop in hashrate and thus security.

We are already seeing hints of this challenge: block subsidies have halved multiple times, but transaction fee revenue has not grown proportionally. As of early 2025, fees make up only a small fraction of miner revenue – on the order of 2–5% in recent years (the other 95%+ is from the subsidy). One report noted that transaction fees contribute just a fraction of total mining revenue, and fee levels remain low relative to the subsidy[43]. Indeed, aside from brief spikes (like during the 2021 bull run or the 2023 meme coin frenzy on Bitcoin when inscriptions drove fees up), Bitcoin’s typical fee per transaction has been a few dollars or less, and many blocks carry only a few hundred dollars in fees. This is problematic long-term: if fees don’t drastically increase (either by many more transactions or higher fee per transaction), the security budget will substantially shrink in coming decades. A recent indicator of this pressure is research by Blockchair (Budget.day) highlighting Bitcoin’s “declining security budget” and warning that if block rewards keep halving and fees don’t rise, the network could eventually become more vulnerable to attack[44][43]. They emphasize that relying on optimistic assumptions (like “price will keep rising” or “hashrate will always grow”) is not a strategy; there needs to be a robust fee market to sustain miners[45][46].

By around 2040, over 99% of all BTC will have been issued. Miners at that point will subsist almost entirely on fees. If by then Bitcoin is only used for, say, 300k transactions a day and users are not willing to routinely pay high fees, miner revenue could plunge. This could lead to fewer miners, more concentration among remaining miners, and potentially hashpower dropping to a level where a large attacker (who doesn’t care about profit, perhaps) could overtake it. It’s an open question whether the fee market will develop sufficiently. Some optimistic scenarios: if Bitcoin is hugely successful and used as global settlement, people might pay \$100 or more per transaction for the privilege (like wiring large amounts or settling bank conglomerates’ books – fees that high would sustain security). Or Bitcoin might primarily be moved on Layer-2s with batched transactions where each block’s fees sum up from thousands of aggregated transfers. But these outcomes are uncertain. Alternatively, some have proposed modifying Bitcoin’s tokenomics – e.g., introducing a “tail emission” (a small perpetual block subsidy, as Monero does) to ensure miners always get some reward. However, that clashes with the sacred 21 million cap and has little support in the Bitcoin community at present.

For comparison, Ethereum’s approach to long-term security is quite different. Ethereum does not have a capped supply; instead, it has moved to a model of minimal necessary inflation. After the Merge, Ethereum’s issuance to validators is around 0.5% – 1% per year, and thanks to EIP-1559 fee burning, Ethereum’s supply actually became deflationary at times when usage is high. But crucially, Ethereum can continue issuing rewards indefinitely to incentivize validators. The Ethereum community seems more open to adjusting parameters to maintain security (for example, if staking returns dropped too low and the network was at risk, they could decide to increase reward or encourage more fees through scaling apps). The flexibility is there, whereas Bitcoin is rigid by design (“set in stone” monetary policy). Solana similarly has an inflation schedule (initially around 8% annual, decreasing to ~1.5% perpetual). This means Solana will always have some block rewards for validators, ensuring a baseline security budget (though high inflation can also devalue the currency, Solana’s design chooses network liveness and security over strict supply caps).

Budish’s analysis and the fee issue together point to a potential ceiling on Bitcoin’s significance if unresolved. It might be that Bitcoin cannot safely secure value beyond a certain scale without either (a) massive on-chain fees or (b) a change in protocol (like tail emission or an auxiliary security mechanism). Neither is guaranteed to happen organically. This is somewhat ironic: Bitcoin’s credibility came from its fixed supply and lean design – but those very features might constrain its ability to become what its fans hope (the foundation of a new financial order).

Again, we must consider game theory and attacker motives. One nuance Budish notes: if an attack would itself crash the price of Bitcoin, the attacker must either be motivated by sabotage (not profit) or have a way to profit outside the system (short selling). A nation-state could be a saboteur, for example, seeking to destroy confidence in Bitcoin by attacking it while holding none. In such a scenario, Bitcoin’s only defense is to be too expensive to attack. But if Bitcoin is important enough to threaten fiat or be worth attacking, it’s likely valuable enough that an entity with deep pockets might attempt it. These are sobering hypotheticals, but they remind us that Bitcoin’s security is probabilistic and conditional – it relies on assumptions about attackers’ resources and motives. The eternal truth here might be that all systems have some breaking point, and Bitcoin is no exception. It might be extraordinarily secure for now, but not absolutely secure against any conceivable future adversary.

To bolster Bitcoin’s security long-term, several things could help: dramatically increased on-chain fees (implying people find enormous value in each transaction); successful layer-2 adoption that increases total fee throughput; widespread adoption driving up value and thus miner rewards (though that cuts both ways as per Budish); or protocol changes like integrating more energy-efficient algorithms or additional consensus tweaks. Bitcoin’s ossified governance makes intentional changes slow and contentious – it’s a feature (resisting centralized changes) but also a bug (inability to rapidly adapt). Ethereum’s more agile governance might give it an edge in addressing any similar issues (for example, Ethereum could choose to increase fees via parameter tweaks or add protocol enforcements if needed, backed by its community process).

In summary, Bitcoin faces an existential question around the year 2140 (and effectively much sooner, as block rewards diminish): Will the network remain secure when miners rely entirely on fees? Researchers and observers are divided – some believe usage and fees will naturally grow to fill the gap (if Bitcoin becomes very important), others fear a “security budget crisis” by mid-century if fees stay low[46][47]. This is an area where unknown unknowns might lurk – perhaps new use cases or technological shifts will change how we use blockchains by then. It is even possible that Bitcoin’s role will shift: instead of trying to be the one chain to rule them all, it could serve as a reserve that other systems periodically anchor to (much like gold sits in vaults while paper money circulates). In such a model, direct transaction volume on Bitcoin could remain low, but it might still secure trillions indirectly by being the final settlement layer.

Ultimately, grappling with these economic limits encourages humility. The hype often proclaims Bitcoin as inevitable, destined to subsume global finance. The analysis here shows it’s not so simple: built-in economic forces could cap its growth unless difficult problems are addressed. As truth seekers, acknowledging these hard truths is crucial – Bitcoin’s design involves trade-offs, and perpetual, limitless growth in significance may not be achievable under its current parameters. Future research, protocol innovations, or even collaboration across chains might be needed to transcend these limits.

The Quantum Computing Threat

On the horizon of technological threats is one that lies outside the blockchain world but could upend its cryptography: quantum computing. Bitcoin (and most cryptocurrencies) rely on cryptographic algorithms – notably the Elliptic Curve Digital Signature Algorithm (ECDSA) using secp256k1 curve for Bitcoin’s public-private keys, and SHA-256 for proof-of-work hashing. Shor’s algorithm, if run on a sufficiently powerful quantum computer, can break the discrete log problem that underpins ECDSA and can also factor numbers to break RSA. In lay terms, a quantum computer of enough qubits and stability could potentially derive private keys from public keys, rendering the signature scheme insecure. It could also invert hashes in ways that threaten mining (though mining might be less immediately affected because SHA-256 collision resistance is a different problem – Grover’s algorithm could give quadratically faster search, but that’s not as devastating as Shor’s algorithm on ECC).

The timeline for quantum computers that could crack Bitcoin’s cryptography is uncertain. For years, experts projected it was decades away – something to maybe worry about in 2040 or beyond. However, recent developments in quantum technology and increasing investments have caused some to update their estimates to sooner. Notably, Anatoly Yakovenko (Solana’s co-founder) warned in 2025 that there is roughly a “50/50 chance” of a major quantum breakthrough by 2030[48]. He urged the Bitcoin community to “speed things up” in migrating to quantum-resistant signatures[48], essentially saying Bitcoin must act fast to upgrade its cryptography before quantum computers render it vulnerable. Yakovenko’s view is on the aggressive side, but it echoes concerns that the progress in related fields (like quantum error correction, scaling qubit counts, and parallel advances in fields like AI) could mean we might be one big discovery away from a quantum leap. In June 2023, a cybersecurity expert, David Carvalho, suggested quantum computers could “plausibly rip through Bitcoin’s cryptography in less than five years” if advancements accelerate[49].

On the other side, many Bitcoin developers and cryptographers maintain that quantum threats are likely 10-20 years out. For instance, Dr. Adam Back (CEO of Blockstream and noted cypherpunk) said current quantum computers do not pose a credible threat yet, estimating maybe ~20 years until they do[50]. Similarly, others like Samson Mow have said it’s a real risk but still probably a decade away[51]. Whether the horizon is 5 years or 20 years, the key point is action will be needed. Bitcoin would require a hard fork to a quantum-resistant signature scheme, because its current addresses and protocol assume ECDSA. Such a fork implies everyone updating software and convincing the community to switch algorithms – not impossible (it’s just a software change) but coordinating a global decentralized community is non-trivial, especially given Bitcoin’s aversion to change unless absolutely necessary.

There’s also a nuance: Bitcoin addresses are often represented as hashes of public keys (especially old-style P2PKH addresses); those coins are somewhat protected even against a quantum attacker until spent (since the public key is not revealed until you use the coin, only a hash which is quantum-secure). However, any reused addresses or any spent outputs where the pubkey is visible on-chain (like all taproot and pay-to-pubkey outputs, and any P2PKH outputs once spent) would be vulnerable. A quantum attacker could target large hoards of Bitcoin whose public keys are known (Satoshi’s coins, exchange cold wallets, etc.) and steal them by forging signatures. This is a nightmare scenario that could collapse trust overnight if it happened unexpectedly.

The likely process to address this would be: before quantum computers reach that point, the Bitcoin community would implement new cryptographic algorithms (post-quantum ones, such as lattice-based signatures or hash-based signatures like Lamport schemes) and users would be encouraged to migrate their funds to new address types secured by those algorithms. We’d have a multi-year grace period where both old and new schemes work, and eventually retire the old one. This requires careful planning and execution – you don’t want to panic the network, but you also don’t want people procrastinating until it’s too late.

Ethereum and others will face similar issues, but arguably Ethereum’s culture of upgrading might make it more nimble in implementing PQC (post-quantum cryptography). In fact, Ethereum has an advantage: it can relatively easily add support for new cryptographic curves or schemes at the protocol and VM level via a hard fork, and Ethereum addresses (being hashes of public keys as well) have similar partial protection. The Ethereum Foundation has been funding research into post-quantum signatures (e.g., evaluating lattice-based signatures that could be used for Ethereum accounts). Solana’s Yakovenko clearly is conscious of the threat; his vocal warning in 2025 indicates Solana’s community might push for proactive steps too.

One interesting twist: quantum computers would threaten not just cryptocurrencies but all digital security – HTTPS, banking, military communications – so there is a global incentive to transition to quantum-safe algorithms. Governments and NIST (National Institute of Standards and Technology) are already standardizing PQC algorithms (NIST announced several winners for post-quantum encryption and signature schemes in 2022-2023). So the tools will be there. The question for blockchains is coordination and timeliness. If Bitcoin is slow to adapt due to internal disagreements or complacency, it could risk catastrophic theft. If, on the other hand, upgrades are implemented in time, the network and its users can migrate smoothly and likely the outside world might not even notice much, beyond some new address formats.

It’s also worth noting that Proof-of-Work mining might need tweaks in a post-quantum world. Shor’s algorithm doesn’t speed up hashing, but Grover’s algorithm can give a quadratic speedup in brute force search, meaning a quantum miner could effectively mine with an advantage (though not a decisive one like breaking signatures). Some have suggested moving to quantum-resistant hashing (there are hash functions believed secure even against quantum, or using longer output schemes) if needed to keep mining fair.

The unknown unknown here is whether a quantum breakthrough happens suddenly (say, a secret lab achieves it and we only find out when coins start disappearing), or whether it’s a gradual and telegraphed process (with milestones like “2048-bit RSA broken” as clear warning shots). The hope is it will be gradual enough that Bitcoin can react. Regardless, quantum computing stands as a predictable cryptographic obsolescence threat – it will happen eventually that current crypto breaks; it’s a question of when.

For truth seekers, the interesting philosophical angle is how something completely external (quantum physics advancements) could render all the game theory and decentralization moot if not addressed – a reminder that even the strongest cryptographic assumptions are contingent on the laws of physics as we know them. In the quest for an “eternal, significant truth,” one might say Bitcoin’s reliance on mathematical hardness is only as good as the permanence of those hardness assumptions. Adaptability is key to longevity. The community that cherishes Bitcoin as immutable must reconcile that some mutation (in cryptography) is inevitable to survive the advance of knowledge.

Fortunately, this is not an insurmountable problem – unlike social or economic issues, cryptography can be swapped out if consensus is reached. It’s an engineering challenge that can be overcome with will and coordination. Ethereum’s Vitalik Buterin once commented that upgrading to PQC is like doing a software update; the harder part is social – ensuring everyone does it in time. So, the real threat might be complacency or denial. As of now, Bitcoiners generally acknowledge quantum as a distant issue and point out more immediate concerns. But the tenor may change as we approach the 2030s and if quantum labs keep hitting milestones.

In closing this section: quantum computing does not undermine Bitcoin’s conceptual contributions – it just targets one implementation detail (the specific cryptographic algorithms). The principle of decentralized consensus can survive the quantum era by swapping in quantum-resistant primitives. However, it’s a race between development/deployment of those defenses and the arrival of the offense. Ethereum, Solana, and others will run that race alongside Bitcoin. The networks that are best at staying agile and truthfully communicating risk will navigate it more smoothly. For Bitcoin, finding the balance between its conservative ethos and the need for fearless introspection (as the user prompt suggests) will be crucial. Ignoring the problem until it’s urgent could be fatal; addressing it too early or chaotically could cause unnecessary alarm. The coming decade will reveal much about the governance maturity of these systems in the face of existential technical change.

Lessons, Legacy, and the Road Ahead

Having examined Bitcoin’s major limitations and threats – from centralization pressures and volatility to environmental costs, market integrity issues, scalability bottlenecks, economic security limits, and looming quantum disruption – it’s clear that Bitcoin is no panacea or end-all-be-all in its current form. Yet, paradoxically, these very challenges underscore Bitcoin’s greatest contribution: it has sparked a global experiment in decentralized trust that is teaching us invaluable lessons. Even if Bitcoin were to falter in the future (due to any of the threats discussed), its legacy will endure in the frameworks and innovations it inspired.

Eternal Insights from a 15-Year Experiment: Bitcoin demonstrated for the first time that it’s possible to achieve consensus in a decentralized network without a central authority, using game-theoretic incentive structures. This is a timeless breakthrough in computer science and economics. The combination of cryptographic primitives (public key cryptography, hash functions, Merkle trees) with an economic incentive (proof-of-work mining and rewards) produced a self-sustaining ledger – a concept that will not disappear even if Bitcoin eventually does. Researchers in distributed systems and finance have learned from Bitcoin about concepts like Byzantine fault tolerance in open networks, the importance of Sybil resistance, and how to engineer incentives for network security. These principles transcend Bitcoin’s specific implementation and inform the design of countless other systems.

Bitcoin also shed light on the tension between theoretical decentralization and practical centralization forces. We’ve seen that open systems tend to recentralize in certain layers (mining pools, exchanges, developer influence) due to human and economic factors. This is an eternal truth that any future decentralized system must grapple with: technology can enable decentralization, but market forces and convenience often pull towards central hubs. The lesson is that careful design and continual vigilance are required to keep systems as decentralized as promised. Ethereum and others took this to heart by, for instance, encouraging multiple client implementations to avoid monocultures, or in some cases implementing on-chain governance to make power structures explicit and more accountable.

Another enduring lesson is in governance without centralized authority. Bitcoin’s governance crises (like the 2015–2017 block size debate) illustrated how hard it is to coordinate a community of anonymous, globally distributed stakeholders toward protocol changes. It was a sort of socio-technical civil war, eventually resulting in a conservative victory (no big block increase on main chain, a split off of Bitcoin Cash as a minority fork, and the adoption of SegWit and later Layer-2 focus for scaling). This episode is now a case study in decentralized governance: it showed the power of the status quo (it’s hard to change Bitcoin’s rules without broad consensus), and also the power of social consensus over code (the longest chain is only “Bitcoin” if users accept its rules – a chain can have more hash but be rejected, as Bitcoin Cash learned). The truth here is that decentralized systems are ultimately governed by communities and social contract, not just algorithms. This has informed how other projects handle upgrades (for instance, Ethereum’s community worked for years to ensure the Merge happened smoothly – learning from Bitcoin’s avoidance of hard forks, Ethereum managed a major change by extensive testing and community buy-in).

Bitcoin’s existence also catalyzed thousands of derivative cryptocurrencies (often called altcoins or now just crypto-assets). Each of these explores different trade-offs or use-cases: some focus on privacy (Monero, Zcash), some on high throughput (Solana, Avalanche), some on smart contracts and general computation (Ethereum, Cardano), others on specific niches (file storage, governance, etc.). While many of these projects will not succeed long-term, the collective experimentation has greatly expanded knowledge. It was Bitcoin that made people realize such things were even possible – a new form of money, a decentralized ledger – and that opened imaginations. One Investopedia article nicely put it: “Bitcoin has not only been a trendsetter...ushering in a wave of cryptocurrencies built on a decentralized network – it has also become the de facto standard that inspired thousands of crypto projects.”[52]. This explosion of innovation is part of Bitcoin’s legacy. Even if one day a more advanced cryptocurrency displaces Bitcoin’s position, that successor will owe a debt to Bitcoin for paving the way and proving out concepts (and indeed likely drawing from Bitcoin’s code or principles).

How Ethereum and Solana Address Concerns: As we compared, Ethereum tackled some of Bitcoin’s issues by design – moving to PoS to address energy use, expanding functionality to address more use cases (which arguably helped Ethereum’s long-term fee market by giving people more reasons to transact, from NFTs to DeFi), and being more adaptive in governance to evolve. Solana and others took different paths, prioritizing certain aspects like speed. It’s too early to declare a single “winner” model; each approach has strengths and weaknesses. Perhaps the future will be interoperable multi-chain, where Bitcoin continues as a robust base value layer, Ethereum as a versatile smart contract layer, Solana (and others like it) as high-speed execution layers – each playing a role, possibly connected by cross-chain protocols. Users might even be unaware of which chain they’re using under the hood if seamless integrations occur. In that scenario, Bitcoin could persist as a crucial piece of the puzzle (for final settlement, as collateral, or as digital gold backing other stable instruments), without having to solve every problem itself. The quest for the ultimate scalable, decentralized, secure system might result not in one chain to rule them all, but an ecosystem of specialized chains.

Uncovering Hidden Truths: One hidden truth Bitcoin has revealed is about the nature of money and trust. It demonstrated that trust – something historically placed in institutions (banks, central banks) – can be partially replaced by open-source code and distributed consensus. This is a profound idea that extends beyond money: it hints at new ways to organize human collaboration and record-keeping (e.g., decentralized governance, supply chain tracking, even art and culture through NFTs). Bitcoin was the first proof that web communities could bootstrap their own money simply through mutual agreement and network effects. This raises deep questions (and some discomfort) about the state’s monopoly on money, about what underpins value, and about how consensus forms. It also exposed less savory truths: for instance, financial systems (crypto included) are prone to greed and bubbles. Bitcoin’s bubbles are reminiscent of historical manias (tulips, dot-com stocks), suggesting that even with a perfectly sound money supply algorithm, human psychology and herd behavior still create instability. That might be an eternal truth: any asset that can be traded will have speculative cycles. Technology alone can’t repeal the business cycle or the bubble cycle.

Another truth illuminated is the importance of transparency vs privacy. Bitcoin’s ledger is transparent, which aids in auditing the monetary base (you can verify how many BTC exist, unlike trusting a central bank). But it also means a loss of privacy compared to cash – something that initially wasn’t fully appreciated. Over time, this spawned research into privacy enhancements (CoinJoin, MimbleWimble, etc.) and other coins like Monero. The delicate balance between transparency (for trust) and privacy (for individual freedom) is a societal issue that Bitcoin brought to the forefront in the digital age. Future systems may strive to achieve both via cryptographic techniques (e.g., zero-knowledge proofs) – an area of active development partly inspired by Bitcoin’s shortcomings.

Survival and Succession: What does the future hold for Bitcoin itself? After analyzing all these vulnerabilities, one might be tempted to predict Bitcoin’s downfall. Yet, Bitcoin has shown remarkable antifragility over its life, surviving exchange hacks, protocol bugs, bans, internal schisms, and relentless criticism. It has a strong, almost religious community that will not let it die easily. That social layer – believers in the “Truth” of Bitcoin’s mission – is perhaps its greatest asset. They provide development, education, hodling through downturns, and evangelism. Even in worst-case scenarios (say a successful attack or a major cryptographic break), it’s conceivable that Bitcoin could adapt or restart in some form because the idea is bigger than the implementation. However, history is rife with technologies that were revolutionary but got replaced by improved versions (MySpace to Facebook, Altavista to Google, etc.). It’s possible that Bitcoin is a first draft and either through a hard fork or via another project, its DNA will carry on in a new form that addresses many of these concerns (for instance, a future cryptocurrency that combines Bitcoin’s monetary policy and decentralization with Ethereum’s flexibility and Solana’s speed and new quantum-proof, privacy-preserving tech – a hypothetical synthesis).

For the coming decade or two, though, Bitcoin is likely to remain a key player, if only because of the immense capital and mindshare invested in it. The emergence of regulated Bitcoin ETFs (expected in 2024) and nation-state adoption (albeit small countries so far) suggest Bitcoin will become more ingrained in the financial world. Paradoxically, that success could bring more political attacks or co-option – another threat we touched on only lightly. Governments might not ban Bitcoin outright if it becomes influential; they might instead hold it (as a reserve) or attempt to control entry/exit points. Already, we saw examples: in 2025, a U.S. Executive Order created a strategic Bitcoin reserve of 200k BTC for the nation[53]. This indicates governments could seek to integrate Bitcoin into their systems rather than fight it, but on their terms. That introduces interesting dynamics: if big powers stockpile Bitcoin, it may boost confidence (like gold in treasury), but if they then influence its development or use (say, push for less anonymity to fit regulation), that could clash with the cypherpunk ethos.

In drawing conclusions, one might say: Bitcoin’s ultimate fate is uncertain, but its impact on our understanding of money, trust, and decentralization is indisputable. Whether Bitcoin itself “succeeds” in becoming the universal currency, or whether it gracefully declines and yields to a successor, the world is now aware of the possibility of non-sovereign digital money. That genie is not going back in the bottle. Even central banks are responding by researching digital currencies (CBDCs), partly inspired by crypto (though those are centralized). The competitive landscape of currencies and ledgers has been forever changed by Bitcoin’s advent.

Innovative Truth-Seeking Nature: Finally, reflecting on the truth-seeking spirit: The journey of analyzing Bitcoin’s limitations is itself a microcosm of the search for truth. It requires cutting through hype, acknowledging uncomfortable facts (like centralization in a “decentralized” system), and being fearless in questioning assumptions (e.g., is proof-of-work truly essential? Can code alone guarantee trust?). In doing so, we gain a deeper appreciation of not just Bitcoin, but the broader quest to create systems that empower individuals with freedom and trust without centralized oppression. Bitcoin opened that door. The ongoing rabbit hole – whether it leads to Ethereum’s world computer, Solana’s fast lanes, or entirely new paradigms – is all part of humanity’s exploration of a new kind of social infrastructure grounded in cryptographic truth rather than institutional authority.

In conclusion, Bitcoin achieved a revolutionary proof-of-concept: it proved that a decentralized digital currency can work at scale. It kickstarted a monetary revolution that is still unfolding. Yet, it also faces existential challenges that call into question whether Bitcoin itself will be the optimal implementation that carries this revolution forward. Bitcoin’s design brilliantly solved some previously unsolvable problems, but left other problems (scalability, long-term security, etc.) to be answered later – now the time to answer them is approaching. Competing implementations like Ethereum and Solana have taken up parts of that challenge by adjusting the trade-offs, showing that there are many possible paths in the design space to address issues like energy usage or throughput, albeit introducing new trade-offs of their own (complexity, different security assumptions).